California's Smart New Retirement Plan and the Industry That Opposes It

Many asset-management companies fear a program that would reduce something they depend on: consumers’ confusion.

Today, half of American households have exactly zero retirement savings, not counting traditional pension plans, which are becoming ever less common, or Social Security. There are two basic reasons for this distressing state of affairs. The first is that many families don’t make enough to cover their basic living expenses. The second is that even people who could put money aside often don’t have easy access to retirement savings programs—which is particularly the case for workers whose employers don’t offer any kind of retirement plan.

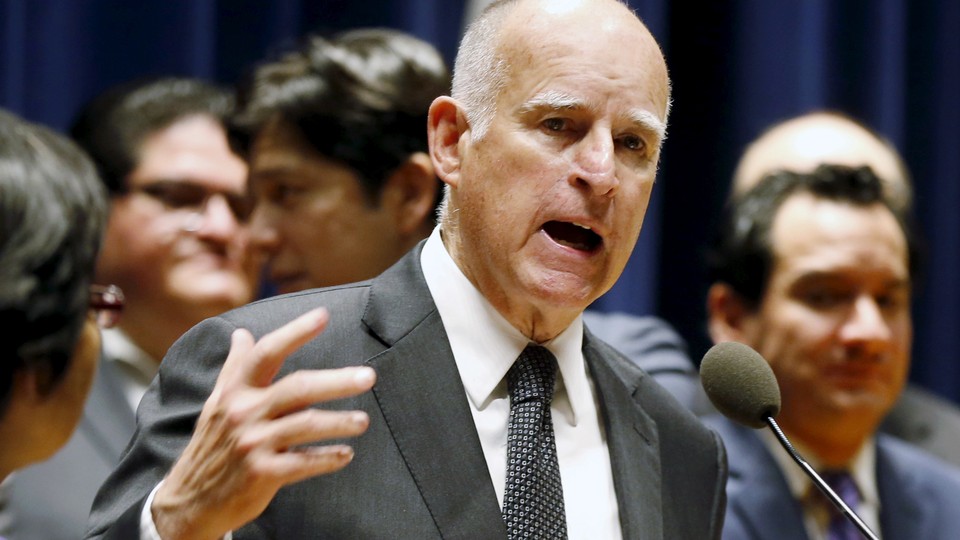

To address this second problem, several states are experimenting with public programs that automatically enroll employees in a retirement plan if their employer doesn’t offer one. California’s plan (which still must be finalized after different versions passed the two houses of the state legislature last week) would automatically cover anyone who works at a company with five or more employees. By default, each participant would save 3 percent of her income, but workers would have the choice to change their contribution percentage or to opt out altogether.

One would think that the asset-management industry would be ecstatic at the prospect of millions of new customers investing tens of billions of dollars. But mutual-fund companies are only happy to bring in new customers if it’s on their terms.

The Investment Company Institute, a lobbying organization for the asset-management industry, is complaining that California’s plan would cap administrative fees—that is, the amount paid to asset managers for taking care of participants’ money—at 1 percent of the total funds invested. The ICI warns that the plan could be considerably more expensive to manage, and the state could be on the hook for the difference.

This is an act of misdirection. For large defined-contribution plans, administrative fees—basically record-keeping and customer-service fees, as opposed to the better-known fund-management fees—are often on the order of 10 basis points, or one-tenth of one percent. That’s what I pay for my University of Connecticut retirement plan and what my wife pays for one of her University of Massachusetts plans.

But, the industry says, a retirement plan for small business employees will have lots of little accounts without much money in them, so administrative fees will be higher than normal. There’s a simple way to debunk this claim. Vanguard is a mutual-fund company that is owned by its investors, so it’s similar to a nonprofit. And anyone with just $1,000 can open an online-only Individual Retirement Account at Vanguard with exactly zero administrative fees. Vanguard covers its costs with its individual funds, which charge management fees that are the lowest in the industry (around 15 basis points, or 0.15 percent, for a target-date fund with a $1,000 minimum investment).

In fact, Vanguard already offers small-business retirement plans with no administrative fees. My family employs a part-time housekeeper and some part-time babysitters. We pay payroll taxes, unemployment insurance contributions, and workers’ compensation insurance premiums. Because we believe in the importance of saving for retirement, we also contribute money to a retirement plan at Vanguard, which has no fees, no matter how small the individual participant’s account.

There are plenty of mutual-fund companies with the scale and computer systems to manage California’s new retirement plan at a cost of less than 1 percent of the assets under management. So what’s going on here? Here’s a theory: The Investment Company Institute is also upset about a Department of Labor rule that allows states to restrict rollovers out of their plans into private-sector Individual Retirement Accounts. “We hoped employees would have the right to move out at any time they wanted,” one of the ICI’s lawyers told The San Francisco Chronicle. That makes it sound like the rule limits workers’ freedom of choice, but in practice it means that asset managers may not be able to vacuum up workers’ retirement savings accounts as workers switch from one job to another.

What the asset-management industry is really afraid of is the consolidated buying power of large, public retirement programs. They are afraid that these new state plans will, by virtue of their size, be able to negotiate low fees from fund companies. And they are especially afraid that many workers will leave their money in those plans for the long term instead of venturing out into the private market, where they can be tempted into expensive, actively-managed mutual funds that generate higher profits for fund companies.

Several decades ago, many workers’ only source of retirement income was Social Security, a public plan that is completely off limits to the asset management industry. The rapid growth of the industry in recent decades is closely linked to the rise of what are called defined-contribution savings vehicles, such as 401(k) plans and IRAs. The George W. Bush administration even sought to privatize Social Security, with the eager support of asset managers.

State plans covering low-income workers are only a small fraction Americans’ total savings, but to the asset-management industry they represent a threat: Public institutions might stand up for the interests of workers and protect them from the marketing gimmicks and high fees through which fund-management companies make their money. There are many reasons why that may not happen, beginning with the enormous influence of asset managers in state legislatures. But for an industry that depends on unsuspecting consumers who feel insecure about financial decisions, state retirement plans are a potential enemy. That’s why fund-management companies are trying to smother the California retirement plan in its current form.